For many banking, financial services, and insurance organizations, the conversation is shifting from whether to modernize digital workspaces to how quickly you can transition. And for IT decision-makers, a new dilemma sits center stage: Should we continue investing in Azure Virtual Desktop (AVD), or does shifting to Windows 365 and Cloud PCs better support our hybrid workforce, security goals, and operational predictability?

The answer is rarely straightforward.

AVD offers deep customization and multi-session cost advantages, while Windows 365 provides a simplified, secure, and persistent Cloud PC experience. However, compliance, risk management, and workforce agility are crucial in the banking, financial services, and insurance industries. Windows 365 is increasingly becoming the preferred path forward.

This article unpacks why Cloud PCs matter, how they align with the evolving needs of these enterprises, and how a partner like Anunta and Microsoft makes the transition seamless and future-ready.

Hybrid work may have originated as a crisis-driven requirement, but it has now become a strategic operating model. Financial organizations face unique challenges:

This requires workspace delivery that is:

This drastically simplifies the hybrid work model while ensuring zero compromise on performance or compliance.

For a financial firm, a secure workspace is not optional; it’s fundamental. With rising threats, insider-driven risks, and stringent regulations, Zero-Trust is the only viable operating model. Simultaneously, regulatory bodies have tightened expectations around security monitoring. Windows 365 provides financial leaders with a compliant-by-design environment with consistent policies, audit visibility, and enforceable controls across all endpoints.

Windows 365 strengthens Zero-Trust implementation through:

In contrast to traditional endpoint management, Cloud PCs reduce attack surfaces and remove inconsistencies in security posture caused by employee-owned or unmanaged devices.

For finance organizations that are frequently audited and tightly regulated, this approach delivers both stronger security assurance and reduced operational risk.

A major challenge in hybrid and distributed financial operations is device inconsistency:

With Windows 365, every user receives a standardized, persistent, high-performance Windows desktop, fully managed through Intune and Microsoft 365.

This offers tangible benefits:

For finance teams handling real-time transactions, compliance operations, underwriting, claims processing, trading analysis, or customer support, this consistency accelerates workflows and eliminates device-related interruptions.

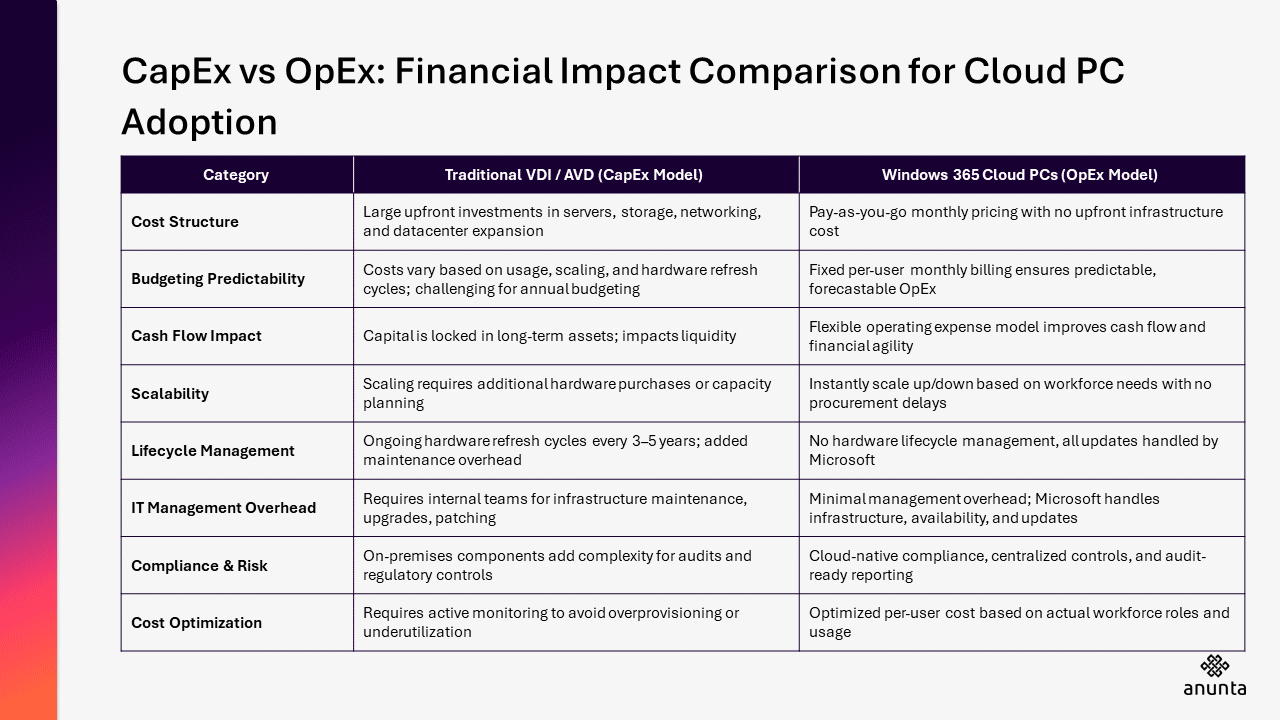

One of the primary drivers of fintech investment is financial predictability.

Traditional VDI and AVD deployments can introduce variable costs tied to Azure resource usage, session loads, and infrastructure scaling. While these models provide flexibility, they also require ongoing optimization and skilled management.

CapEx vs OpEx: Financial Impact Comparison for Cloud PC Adoption

This aligns perfectly with finance budgeting frameworks, where long-term planning, fixed OpEx, and minimized operational uncertainty are essential.

The shift to Cloud PCs is not a binary decision. Many banking, financial, and insurance enterprises adopt a hybrid model:

The move toward Windows 365 is driven by its ability to deliver:

Cloud PCs provide the secure, auditable, policy-driven environment needed to operate confidently in a hybrid world.

Transitioning to Cloud PCs requires more than technology; it needs strategic planning, operational alignment, and deep understanding of financial environments. This is where Anunta’s specialized capabilities make a transformative difference.

1. Strategic Advisory for Finance Requirements

Anunta conducts detailed assessments covering:

The result: A migration roadmap aligned with banking, finance, and insurance governance frameworks and industry expectations.

2. Architecting Secure, Compliant Workspace Environments

Leveraging Microsoft’s best practices, Anunta builds Cloud PC architectures that integrate:

This ensures finance workloads stay fully compliant and resilient.

3. Seamless Migration with Minimal Disruption

From physical desktops to legacy VDI to AVD-to-Windows 365 transitions, Anunta ensures:

Employees experience continuity with no drop in productivity.

4. Lifecycle Management & Continuous Optimization

Post-deployment, Anunta manages:

This provides IT teams with operational peace of mind while ensuring compliance and uptime.

With over a decade of workspace transformation experience and deep specialization in Azure and Windows ecosystems, Anunta is uniquely positioned to guide banking, finance, and insurance organizations into the future of work.

Our partnership with Microsoft ensures that these enterprises benefit from:

The result is a secure, scalable, and modern digital workspace designed for complex finance operations.

Choosing the right Cloud PC model requires clarity across security, compliance, architecture, applications, workforce needs, and cost planning.

To help finance leaders make informed, confident decisions, we have prepared an in-depth resource: AVD to Windows 365 migration blueprint for financial institutions.

Research Review with Anunta’s CTO | Jan 14 | 12PM PST/3PM EST